- #Quickbooks small business track mileage manual#

- #Quickbooks small business track mileage for android#

- #Quickbooks small business track mileage Pc#

#Quickbooks small business track mileage for android#

In addition, the development team is adding on features for Android and iPhone users to enhance the feature, such as location-based rules a user can set to classify the same frequent trips as business.

#Quickbooks small business track mileage manual#

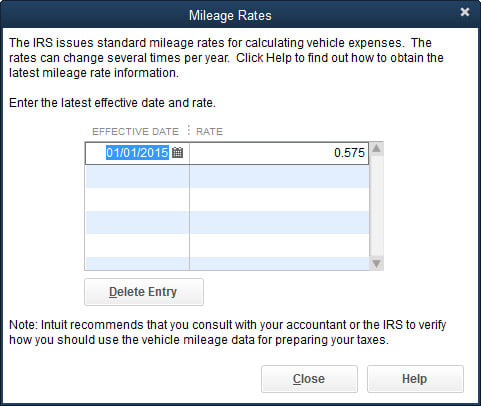

That saves time for the user in not having to keep manual logs, while automating the workflow for the accountant.” Next steps for mileage trackingĬurrently, only the master administrator for a QuickBooks Online account has access to mileage tracking, but Evett reports that this will soon change. “QuickBooks Online generates a mileage report that can be reviewed and easily put into tax preparation software. “While $2.26 may seem insignificant to the user, we know that multiple trips can add up to big deductions come tax time,” says Evett. For example, on a trip of 3.9 miles between point A and point B, the tax deduction would be $2.26. QuickBooks instantly shows the dollar amount based on current IRS mileage rates (always updated) and what the tax deduction would be. Users click on “mileage’ on the navigation bar, put in the beginning and end locations, and miles driven, then classify the trip as personal or business.

#Quickbooks small business track mileage Pc#

Manually entering mileage is also available if clients are tapping into QuickBooks Online on their desktop via the Mac or PC app, or over the internet. “The new mileage tracking feature in QuickBooks Online offers the same great functionality found in QuickBooks Self-Employed and MileIQ, but it’s now right inside my QuickBooks Online account!” Manually adding mileage

“Intuit continues to add the technology and features I need to run my business all in one place,” says Heather Satterley of Satterley Training & Consulting. It’s also worth noting that if a QuickBooks Self-Employed user finds that they need to switch to QuickBooks Online, then the miles that they entered into QuickBooks Self-Employed will carry over. They can also save a customized name to a specific address as a “favorite,” making it easier to remember which trips are business and which are personal. If the contractor travels between San Diego and Los Angeles, they simply navigate to the mileage tab on the mobile app to track a trip. Let’s say your client provides home and commercial contractor services, with the need to visit multiple job sites in person. “For example, with only a simple swipe – a typical smartphone gesture all of us are very familiar with – QuickBooks Online can keep a very clear record of business mileage you can claim on your taxes.” “This is a huge benefit for users who don’t want to manually add their information into QuickBooks Online,” explains Evett. The mobile QuickBooks Online app uses GPS, cell towers and Wi-Fi to triangulate a user’s location, providing pinpoint accuracy and automatically recording the miles driven for any business-related trip. With small business owners and staff having little to no time left to spend on administrative matters, one of the key advantages of the new mileage tracker is its built-in automation. “Now that mileage tracking is available in QuickBooks Online, our hope is that it’s easier than ever for small business owners to manage their mileage and get bigger deductions, allowing them to hopefully keep more money in their pockets at tax time.” A simple swipe enables mileage tracking “Mileage deduction can be one of the biggest deductions that a self-employed or small business owner can claim to reduce their tax bill,” says Evett. She explained that many small business owners wanted the ability to track mileage, but they needed the higher-level functionality of QuickBooks Online versus QuickBooks Self-Employed, which is designed for businesses of one. Previously only available in QuickBooks Self-Employed, this feature is available in the United States and will soon be available in Canada, the United Kingdom and Australia.Ĭhantal Evett, a product manager who oversees the mileage tracking feature, says Intuit heard loud and clear from its small business customers, and from accountants who work with them, that this feature was needed in QuickBooks Online.

The mileage tracking feature - which allows your clients to track their mileage, simply and easily while on the go - is now available in QuickBooks Online and QuickBooks Online Advanced. Manual, written logs are neither effective for automated workflow, nor are they necessarily accurate, especially if a client forgets to record their mileage right away and guesstimates it at a much later time. The days of clients giving you dog-eared pages with unintelligible scrawls of mileage driven for business is now a thing of the past.

0 kommentar(er)

0 kommentar(er)