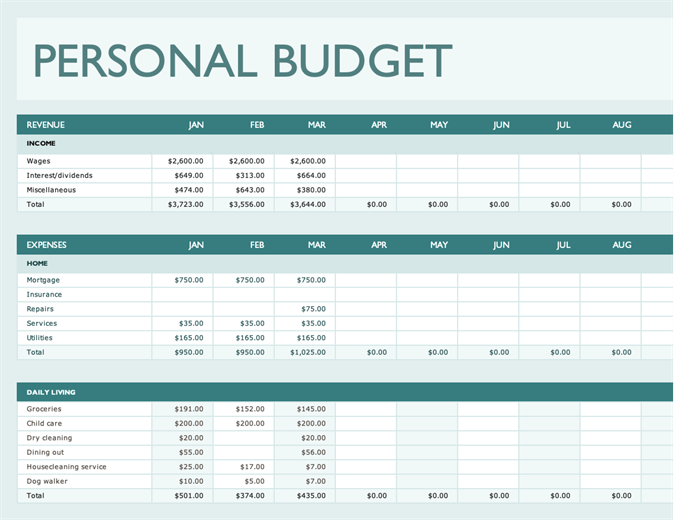

Simple Budget Planner – For a more compact budgeting spreadsheet that lets you budget expenses by the annual and monthly income percentage.So what exactly can you expect to find for your budgetary needs? You can get these from the Google Docs Template Gallery, where you’ll find some great options for Google Sheets. What are your financial template options?

#Best personal budget template excel free#

Head to /kim and get a free product tour.

#Best personal budget template excel software#

Ditch the spreadsheets and all the old software you’ve outgrown. Stop paying for multiple systems that don’t give you the information you need when you need it. Whether doing a million or hundreds of millions in revenue, NetSuite can save you time and money. NetSuite gives you visibility and control over your financials, HR, inventory, e-commerce and more - all in one place, instantaneously. It’s so much more than just accounting software. ^ "The 8 Best Personal Finance Software Options of 2022".^ "5 Essential Steps to Create a Successful Personal Budget".

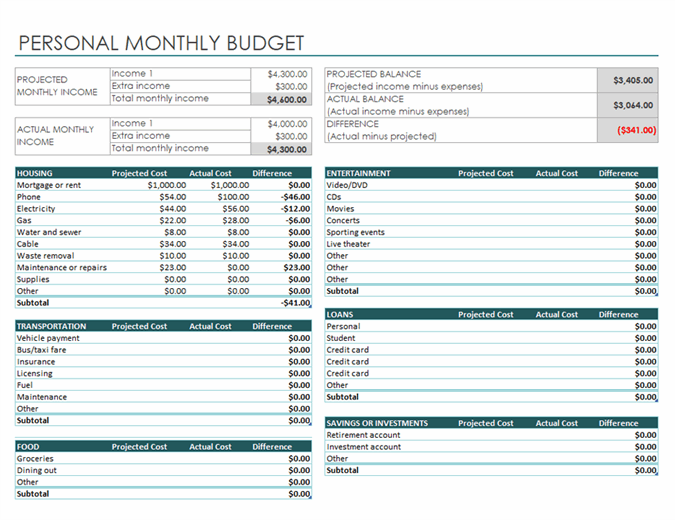

The 50/30/20 budget is a simple plan that sorts personal expenses into three categories: "needs" ( basic necessities), "wants", and savings. These steps can help individuals gain better control over their finances and achieve their financial goals.

This method involves assessing one's financial situation, setting realistic financial goals, allocating income, tracking spending and adjusting the budget, and regularly reviewing and revising the budget. There exist many methods of budgeting to help people do this. In the most basic form of creating a personal budget the person needs to calculate their net income, track their spending over a set period of time, set goals based on the information previously gathered, make a plan to achieve these goals, and adjust their spending based on the plan. People who budget their money are less likely to obtain large debts, and are more likely to be able to lead comfortable retired lifes and to be prepared for emergencies. Having a budget can help people feel more in control of their finances and make it easier for them to not overspend and to save money. Personal budgets are usually created to help an individual or a household of people to control their spending and achieve their financial goals. A personal budget (for the budget of one person) or household budget (for the budget of one or more person living in the same dwelling) is a plan for the coordination of the resources (income) and expenses of an individual or a household.

0 kommentar(er)

0 kommentar(er)